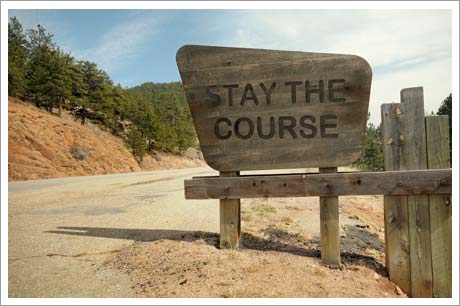

A good course of action is to put money into your long-term investments on a regular basis. Let’s look at one family that had setup their Roth IRAs before the 2007-8 market losses. When they lost money in their accounts, he decided to stop putting money in because he wasn’t sure it was still a good idea. She, on the other hand, kept contributing. The difference in their accounts 5 years later was shocking. You see, even though she didn’t like losing money in 2007-8, she kept investing each month and she bought more shares when the market was low. He, on the other hand, waited for the share prices to go back up before contributing again and, thus, bought his shares at a higher price than she did. Buy low and sell high is still the best idea. So, yes, even though we feel the losses twice as much as we feel gains, consistent long-term investing is a good approach for establishing the kind of retirement you would like.

www.selahfs.com